An Unnecessary Gamble with the U.S. Economy

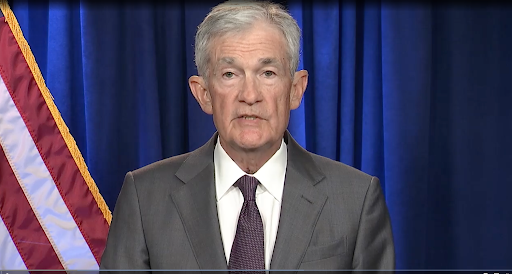

Statement from Federal Reserve Chair Jerome H. Powell after receiving a subpoena from the Department of Justice. Source: Investopedia.

The Department of Justice has threatened Jerome Powell, the chairman of the Federal Reserve, with a criminal indictment. The threat is connected to Powell’s summer testimony regarding a $2.5 billion Federal Reserve building renovation, as the Justice Department is reportedly investigating whether he misled Congress about the project’s scope and costs. Powell called the investigation a political attack on the Federal Reserve, arguing it was motivated by the Fed’s refusal to lower interest rates to please the president and its choice to follow economic data over the president. President Trump, since taking office last year, has repeatedly attacked Powell for resisting interest rate cuts, blasting him on Truth Social last July as “TOO LATE, TOO ANGRY, STUPID & TOO POLITICAL” after the Fed held rates steady. These recent attacks, orchestrated alongside Trump’s longstanding pressure, expose the president’s transactional approach. He appears motivated to secure a final term marked by low interest rates and an all-time-high stock market to champion his presidency as one of the best in American history, regardless of the consequences that prematurely cutting rates would have on low-income families or on the stability of the global, dollar-based economy.

Since the Fed was created in 1913, no president has tried to oust a central bank official. Its independence has always been carefully protected due to the weight of its responsibility. These recent actions against Powell have raised unprecedented concerns for the United States and its financial stability. Powell, however, has consistently prioritized the Federal Reserve’s dual mandate of price stability and maximum employment over short-term political demands, maintaining an independent course rooted in economic data rather than White House pressure.

The Administration’s campaign, however, is not limited to Powell. The President is currently locked in a legal battle to fire Fed Governor Lisa Cook over unconfirmed allegations of mortgage fraud. This case reached oral arguments at the Supreme Court on January 21, 2026. Even conservative justices on the Court appeared skeptical about the case’s urgency and its potential detrimental effects. Trump’s appointees, Kavanaugh and Barrett, openly expressed concerns about economic instability resulting from Trump’s argument. Most surprisingly, Samuel Alito, a staunch conservative, said, “Is there any reason why this whole matter had to be handled by everybody… in such a hurried manner?” This skepticism by Trump's appointees highlights the broader concern that the administration’s aggressive actions against Fed officials are politically motivated, prioritizing the president’s personal and legacy-driven goals over economic stability.

However, there is still hope beyond Powell's individual efforts to win this battle for independence. In an unprecedented defensive move on December 11, 2025, the Board of Governors voted early to reappoint 11 regional bank presidents to new five-year terms. This strategy ensures that even if a political loyalist replaces Powell when his term expires this May, the committee that sets interest rates will remain dominated by independent experts. By locking in these leaders until 2031, the Fed is shielding itself from White House attempts to control the nation’s money supply.

So far, Jerome Powell and the Federal Reserve Board have done an admirable job of maintaining economic stability despite intense political pressure. However, uncertainty remains about the future of the Fed’s independence and its impact on both the domestic and global economy. Undermining this independence would give future presidents greater power to influence the Fed for their own monetary goals, without regard for long-term economic stability. Such a loss of independence could result in reduced purchasing power for the public, higher inflation, and increased unemployment.

Powell’s term as chair is set to expire in May 2026, and due to the President’s growing resentment, a reappointment is no longer a possibility. Trump has appointed Kevin Warsh, a former Federal Reserve governor and Morgan Stanley executive, to succeed Powell. Surprisingly, he's known to have a stance to favor inflation control through high interest rates. However, more recently, he has signaled a policy shift, aligning more with calls for lower interest rates under the Trump administration. The president has repeatedly linked Warsh’s selection to his preference for lower interest rates, saying if Warsh had wanted to raise rates, “he would not have gotten the job.” Appointing a "yes-man" who aligns his decisions with the President's tweets rather than economic data would be disastrous, potentially triggering the very inflation the Fed is designed to prevent.

It is still unclear whether Warsh will be able to push the Fed to lower interest rates immediately upon taking the position. Fortunately, interest rates are not set by the chairman alone but by the entire Federal Open Market Committee (FOMC). The FOMC consists of the seven Board of Governors and five regional Federal Reserve Bank presidents, and each member has one vote, so the chairman’s vote is just one of twelve. This structure may limit the potential for abrupt changes. Nevertheless, the administration’s actions could still undermine institutional trust and strain the traditional independence between the executive branch and the Federal Reserve.

For anyone interested in American hegemony and financial stability, these actions should be deeply troubling. Venezuela and Argentina provide clear examples of ‘loyalist’ central banking, where political pressure led to runaway inflation and the breakdown of the middle class. For students today, this is not just a Washington drama; it is a battle over future car loan interest rates and the purchasing power of their first paychecks. If the Federal Reserve yields to Trump’s politically motivated pressure and cuts rates prematurely, inflation and instability will follow, along with a loss of public trust in institutions meant to serve citizens rather than political interests.